unrealized capital gains tax janet

Ron Wyden D-Oregon would impose an annual. The unsold wealth of the super rich are often transferred.

Treasury Greenbook Proposes To Raise Taxes On Corporations And Wealthy Accounting Today

An unrealized capital gains tax would violate this.

/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

. Say that you own a home worth 150000. If you still owned the house when it was valued at 350000 as opposed to selling it you would have grossed. It goes against the concept of taxing income because thats a tax on generated cash flow whereas there is no generated cashflow in this event and theres still a tax on it.

For example perhaps you purchased a house at 300000 and sold it for 350000. An unrealized capital gains tax would change the stock market forever. Essentially its a way to tax.

Let me unravel what unrealized capital gains means through an illustration. If you are in the top tax bracket your long-term capital gains tax rate would be 20 of 200 on your 1000 profit. Senior Democrats confirmed that a proposal to tax billionaires unrealized capital gains will likely be included in President Bidens 2 trillion spending packageTreasury Secretary.

The phrase unrealized capital gains has been trending on social media and forums during the last 24 hours after the US. It is the theoretical profit existent on paper. Unrealized capital gains put simply is the increase in the value of an asset that has yet to be sold.

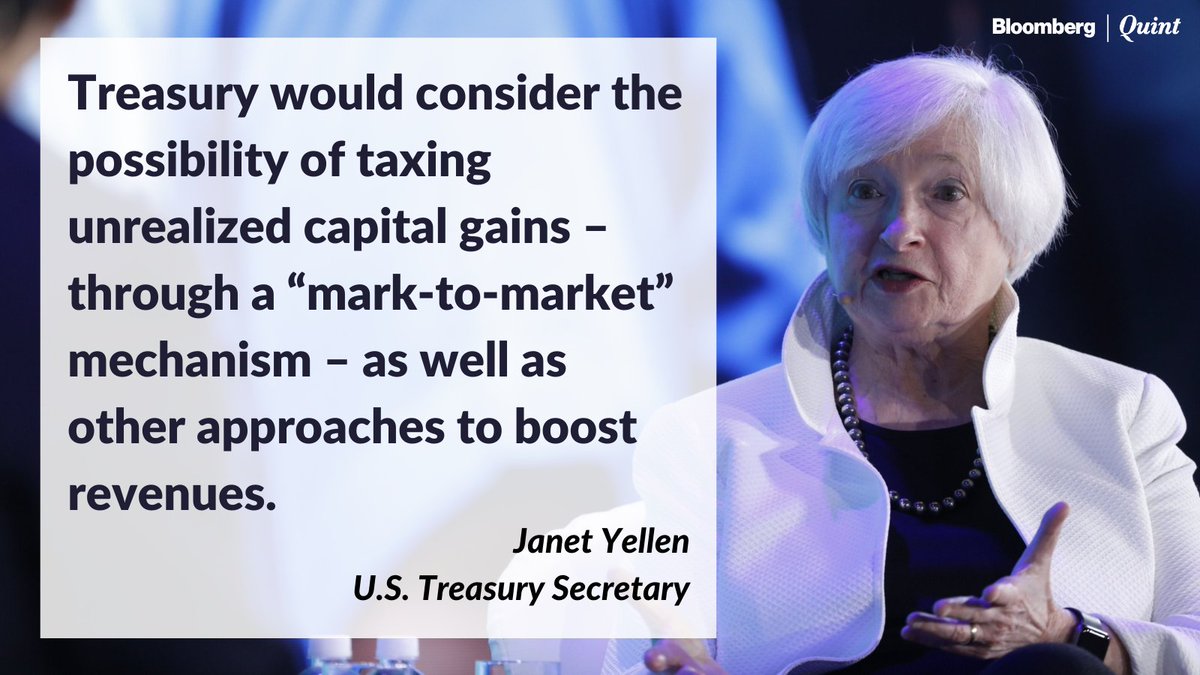

Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed a tax on unrealised capital gains. Janet Yellen Bidens nominee for Treasury Secretary reportedly said she would consider taxing unrealized capital gains to boost government revenues. US Treasury Secretary Janet Yellen has proposed a tax on unrealised capital gains of billionaires.

Thank you Senator. Meaning that when assets such as stocks crypto and real estate appreciate that value is taxed at the same rate as your income. It looks like Janet Yellen would like to tax unrealized capital gains.

You get taxed on 100 of any gain but capped at 3000 loss. Not exactly sure how that would work especially if the next year the stock price drops below what you paid for it. Treasury Secretary Janet Yellen announced on October 23 that a proposed tax on unrealized capital gains yes gains from investments that havent even been sold yet.

To pay for the 5 trillion love letter to progressives the Democrats have floated taxing unrealized capital gains. Secretary Janet Yellen has been discussing in various media the Biden administration is now revealing an unrealized capital gains tax from stocks and bonds. Secretary of the treasury Janet Yellen discussed the subject on CNN.

The plan will be included in the Democrats US 2 trillion reconciliation bill. This proposal suggests that we should be taxing unrealized capital gains as income. The exact magnitude of the capital gain is 2000 gross proceeds minus 1000 cost basis resulting in a long term capital gain of 1000.

Treasury Secretary Janet Yellen explained on CNN Sunday that the proposal raised by Sen. In other words if a transaction occurs in which a tax payer does not have the funds to pay a tax generally wouldnt be owed. Eagle-Keeper January 21 2021 951pm 1.

Capital gains tax is a tax on the profit that investors realize on the sale. This profit is a capital gain. Lets say the government through insanely reckless spending and money printing causes inflation and just for good measure artificially shuts down the economy for a year and throws millions of people out of work.

But now Democrats are reaching deep into their grab-bag of revenue tricks and may pull out a wealth tax on billionaires. As Cathie Wood states it is the worst proposal of all when it comes to stock marke. There is also something called the Net Investment.

Be sure to like and subscribe and hit the bell button for channel alertsSend Fan Mail with USPS ToCOMMANDER VLOGSPO BOX 643EAST OLYMPIA WA 98540Send Fan. Yellen made the remarks in response to a question from Tapper about whether a wealth tax should be part of how Democrats look to pay for Bidens 35. A 2 drawdawn on your unrealized capital gains requires people to have set aside cash for that very tax purpose.

Earlier in 2021 Yellen proposed taxing unrealized capital gains to boost US. No I didnt just make that up. Treasury Secretary Janet Yellen told CNNs Jake Tapper on Sunday that Senate Democrats are considering a proposal to impose a tax on unrealized capital gains of the wealthiest Americans.

There is a principle in taxation that has been long-standing practice in the United States that financial wherewithal is key to a tax being owed. Jan 22 2021 - 204am. Government coffers during a virtual conference hosted by The New York Times.

Would you then get. Democrats have proposed partly funding some of their multitrillion-dollar spending plan with a tax on the unrealized capital gains of anyone who. The new Billionaire Income Tax is being written by Senate Finance Committee Chairman Ron Wyden Democrat.

John Neely Kennedy R-LA said a proposed unrealized capital gains tax will affect millions and millions of middle-class Americans and maul the real-estate market and the market for other long-term assets while appearing on Tucker Carlson Tonight Thursday. Unrealized Capital Gains Tax In this presentation I will be discussing a proposal brought by Janet Yellen at the department of treasury and our current federal government. Nobut if you lose almost all of it and it goes back up those will be gains that are taxed.

Governments are always evil. Capital gains tax is a.

No U S Won T Tax Your Unrealized Capital Gains Alexandria

An Unrealized Capital Gains Tax Would Wallop Big Stock And Bitcoin Investors Nasdaq

Us Government Unrealized Gains Tax Plans Might Hit Crypto Billionaires Too

Why Congress Shouldn T Rush To Enact Poorly Conceived New Taxes To Fund Spending Spree The Heritage Foundation

An Act Of War Against The Middle Class Americans Criticize Janet Yellen S Idea To Tax Unrealized Capital Gains Buyucoin Blog

/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

Yellen Argues Capital Gains Increase From April 2021 Not Retroactive Bloomberg

Opinion Biden S Latest Tax The Rich Scheme Would Be An Unworkable And Possibly Unconstitutional Mess The Washington Post

Elon Musk Weighs In On Unrealized Capital Gains Tax Idea Channelchek

Best Argument Against Unrealized Capital Gains Tax Janet Yellen Capital Gains Tax Youtube

Treasury Secretary Janet Yellen Says Taxing Unrealized Capital Gains Is A Possibility Youtube

Why The Fed Needs Janet Yellen To Steal W Unrealized Capital Gains Avoiding Taxes W Roth Iras Youtube

An Unrealized Capital Gains Tax Would Wallop Big Stock And Bitcoin Investors Nasdaq

Democrats Look To Billionaire Tax On Unrealized Capital Gains Fortune

Therapist Are The Unrealized Capital Gains In The Room With Us Now Janet R Bitcoin

Janet Yellen Favors Higher Company Tax Signals Capital Gains Worth A Look Business Standard News

Does Treasury Secretary Yellen Really Want Unrealized Capital Gains To Be Treated As Income Swfi

Uzivatel Bq Prime Na Twitteru Yes Taxation Of Unrealised Stock Market Gains Seems Unusual But It Is Already Embedded In The System Argues Shankkaraiyar Calling For A One Time Tax On Billionaires He